Cameron Appraisal District 2024 Reappraisal For Property Taxes

O'Connor has finished an analysis for the Cameron Appraisal District 2024 Reappraisal for Property Taxes.

BROWNVILLE , TEXAS , UNITED STATES , May 7, 2024 /EINPresswire.com/ -- Cameron Appraisal District Facts

Except for Potter and Randall counties, which share a single appraisal district, every Texas county has its own. Cameron County Central Appraisal District’s annual budget is $6.13 million as of 2022, the most recent period for which data is available. A team of 67 appraisers value approximately 216,800 property tax properties.

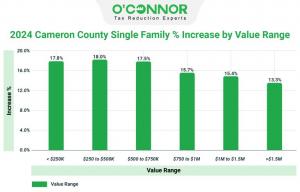

Cameron County 2024 Single Family Increase At 17.7%

The properties priced between $250,000 and $500,000 experienced the highest increase, at 18%. Other home value groups with notable increases include those valued at less than $250k, which saw a rise of 17.8%, and those valued between $500k and $750k, which experienced a 17.5% increase.

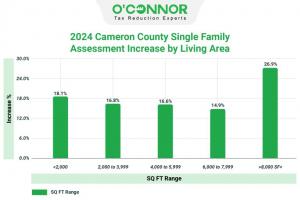

In Cameron County, gains in property value were fairly consistent, irrespective of the size of the residence. Although properties with larger square footage experienced a more pronounced escalation in property tax assessment, particularly those surpassing 8,000 square feet, which went up by 26.9%. For homes measuring less than 2,000 square feet, the property tax assessment increase with the second-largest percentage increase is approximately 18%.

Cameron County Home Tax Reappraisals Increase At 17.7%

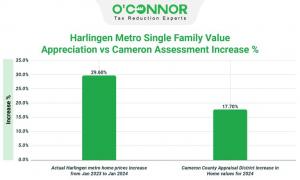

The assessed value of homes in the Harlingen metro region climbed by 29.60%, whereas the Cameron Appraisal District saw just a 17.7% rise. The Harlingen Association of Realtors reported.

Cameron County Tax Assessments Based on Year Built

At first glance, based on assessments set by the Cameron Appraisal District in 2024, the property tax reappraisals for properties categorized as “others” in Cameron County appear greater than those for any other construction year group of residences. The range of year built with the largest increase in value at 46.2% belongs to homes categorized as “others”, meaning no year of construction is recorded in the tax account. For the majority of tax accounts construction year data is available, and the range with most significant increase is residential property built prior to 1960. The Cameron County property tax reassessment for 2024 showed that homes constructed between 1981 and 2000 had the lowest increase, at 15.5%. According to the Cameron County Central Appraisal District, house values in the county rose by almost 18%.

The Cameron County Central Appraisal District overvalued 54% of the county’s residences in 2024. This research is based on comparing the sales price of a house sold in 2023 to the 2024 property tax reassessment value. In contrast, 46% of homes sold in 2023 were valued at less than the 2024 sales price.

Cameron County Commercial Owners Face Modest Tax Revaluations!

All commercial property owners in Cameron County should actively oppose their property taxes in 2024. It seems that a significant number of property owners had substantial increases compared to the prior year. . Warehouse property had the largest surge, with a remarkable 51.7% gain in value, soaring from $274.9 million to $416.9 million. Office buildings see the lowest growth rate, with a rise of just 6.4%.

Regardless of the year constructed, commercial property assessments established by the Cameron Appraisal District for 2024 skyrocketed. Cameron County commercial property constructed before 1960 had a 29.4% rise. According to the Cameron l Appraisal District’s property tax reevaluation in 2024, the 20.5% rise in value of properties constructed between 1961 and 1980 was the lowest in the 2024 property tax reassessment.

Disconnect Between CCCAD Values and Wall Street Bankers

The 2024 commercial property tax reassessment reported by the Cameron Appraisal District shows a significant disparity and contradicts the analysis by Wall Street firm Green Street Real Estate Firm. According to the Cameron Appraisal District, commercial property values surged by 25.6% in the past year.

Property Increase in Taxable Value by Value Range

Commercial property assessments in Cameron County show notable increase for all assessed value categories, all value ranges exceeding 20% for the 2024 tax year. Properties valued under $1M surged by approximately 29%, whereas those valued between $1 million to $5 million only increased by 21.3%.

Cameron County Apartment Property Increase by Year Built

The collective 2024 property tax assessments for apartment buildings in Cameron County experienced growth. The greatest increase occurred in apartment buildings constructed prior to 1960, which rose by 28.4% in value from $15 million in 2023 to $20 million in 2024. The apartment buildings constructed from 1961 to 1980 experienced the least amount of appreciation in value, rising from $141 million to $146 million, or 3.3%.

Cameron County Office Buildings Percentage Increase by Year Built

The Cameron County Central Appraisal District states that office buildings constructed between 1981 and 2000 had the highest increase of 8% in property tax assessments for 2024. The 1.5% rise recorded by the office building classified as “others” was the lowest. The overall rise for all year constructed ranges has been around 6.4%.

Cameron County CAD Retail Tax Assessments Up 32%

Office building property tax assessments in Cameron County increased across all ranges of construction year. The largest increase was in retail buildings constructed between 1961 and 1980, which rose by 38.7% in value from $167 million in 2023 to $231 million in 2024. The value of retail buildings constructed in 2001 and above increased by 28.5%, from $527 million to $677 million.

The owners of warehouse buildings in Cameron County had a significant average rise of 51.7% in their property tax assessment between 2023 and 2024. There has been a pronounced surge in the value of warehouse buildings in Cameron County constructed since 2001. The value of these buildings increased from $97 million to $161 million, representing a 65% growth. The market value of warehouse buildings constructed before 1960 have experienced a similar hike, amounting to 59.7%.

Office Building 2024 Reassessment by Type

In 2024, property tax assessments increased for all kinds of office buildings in Cameron County. Small office buildings had the greatest rise, at 9.2%, compared to large office buildings, which increased by just 5.7%.

2024 Apartments Property Tax Revaluation by Type

Property tax assessments for all types of apartment complexes in Cameron County increased in 2024. Multi-plex frame accounts saw the lowest rise, rising from $338 million to $372 million, a 10.3% increase. Garden Apartment had the most significant rise, rising from $3.7 million to $4.7 million, a 27% increase.

2024 Retail Property Tax Revaluation by Type

Three out of the four retail property types in Cameron County had increases in property tax assessments in 2024. Regional shopping center had the lowest growth, which remained unchanged from 2023. Neighborhood shopping strip had the biggest rise, going from $382 million to $546 million, or 42.9% increase.

Cameron County CAD Warehouse Revaluations by Type

Two types of warehouse property for which the Cameron County Central Appraisal District establishes market values are office warehouses and mini warehouses. An 88.2% increase from $59 million to $111 million was recorded for mini warehouses. The lowest percentage increase of the two property categories, office warehouse values rose 41.7% from $215 million to $305 million.

Summary for Cameron County CAD 2024 Property Tax Revaluation

Cameron County property owners are dealing with significant increases for both residential and commercial properties. Reported increases were somewhat less for Cameron County than for the Harlingen metro area.

For commercial real estate, the gains were significant. Market trends for commercial real estate have been difficult for some and downright unpleasant for others. Most commercial property owners would probably concede in private that the value of their properties has decreased over the last several years. Interest rates rising from 1.71% in January 2022 to 4.05% in January 2024 is partly to blame for this. It is also a result of somewhat flat revenue patterns combined with significant and ongoing increases in casualty insurance and other operational costs.

Appeal Your Property Values Each and Every Year

Texas property owners, and more especially those in Cameron County, have the right and would be wise to challenge the assessed value of their property. Owners of residential and commercial properties may submit evidence in the appeal process to support their claim that the assessed value is high. Owners should seriously consider filing an appeal or hiring a property tax consulting company since most property tax protests are successful. O’Connor has fifty years of expertise protesting the values of residential and commercial properties, and they have the means to back up their main goal of improving property owners’ lives by lowering taxes at a reasonable cost.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.