Digital Remittance Service Market to Hit $5220.77 Bn By 2032, U.S. Regions Driving Digital Remittance Service Growth

Digital remittance refers to the transfer of money through online platforms, offering an efficient alternative to traditional methods.

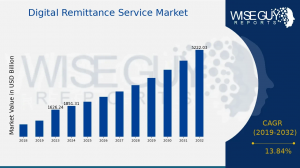

NEW YORK, NY, UNITED STATES, January 13, 2025 /EINPresswire.com/ -- According to a new report published by Wise Guy Reports (WGR), The Digital Remittance Service Market was valued at $𝟭𝟴𝟱𝟭.𝟯𝟭𝗯𝗶𝗹𝗹𝗶𝗼𝗻 in 2024 and is estimated to reach $𝟱𝟮𝟮𝟬.𝟳𝟳 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 by 2032, growing at a CAGR of 𝟭𝟯.𝟴𝟰% from 2024 to 2032.The digital remittance service market has witnessed significant growth over recent years, driven by the increasing adoption of digital solutions for cross-border money transfers. Digital remittance refers to the transfer of money through online platforms, offering an efficient alternative to traditional methods. Key factors contributing to market growth include the rise in global migration, the growing penetration of smartphones, and advancements in payment technologies. Digital remittance services are widely adopted due to their cost-effectiveness, convenience, and speed. The market is poised for further growth as financial inclusion improves and demand for transparent financial services increases worldwide.

𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗥𝗲𝘀𝗲𝗮𝗿𝗰𝗵 𝗦𝗮𝗺𝗽𝗹𝗲 𝘄𝗶𝘁𝗵 𝗜𝗻𝗱𝘂𝘀𝘁𝗿𝘆 𝗜𝗻𝘀𝗶𝗴𝗵𝘁𝘀:

https://www.wiseguyreports.com/sample-request?id=579597

𝗠𝗮𝗿𝗸𝗲𝘁 𝗞𝗲𝘆 𝗣𝗹𝗮𝘆𝗲𝗿𝘀

Prominent players in the digital remittance service market include companies like PayPal Holdings, Inc., Western Union Company, Remitly, Inc., TransferWise Ltd (now Wise), and WorldRemit. These firms are leading the industry by introducing innovative features, user-friendly interfaces, and competitive pricing. Emerging players like Revolut and Azimo are also gaining traction by targeting niche customer segments and providing enhanced digital experiences. Strategic collaborations, mergers, and acquisitions among these players are intensifying market competition. As the landscape evolves, these companies are focusing on leveraging blockchain and AI technologies to streamline operations and enhance customer trust.

𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗲𝗴𝗺𝗲𝗻𝘁𝗮𝘁𝗶𝗼𝗻

The digital remittance service market is segmented based on type, application, and end-users. By type, the market is divided into inward and outward remittances, with inward remittances holding a significant share due to the large inflow of funds in developing economies. Applications include personal remittances, business remittances, and social remittances. Personal remittances dominate the market due to increasing migration and diaspora populations. End-users are categorized into individuals, businesses, and NGOs, with individuals representing the largest user base. This segmentation enables companies to cater to diverse needs and tailor their services to specific demographics and use cases.

𝗠𝗮𝗿𝗸𝗲𝘁 𝗗𝗿𝗶𝘃𝗲𝗿𝘀

The primary drivers of the digital remittance service market include globalization, rising migration trends, and the growing reliance on digital payment methods. The increasing number of expatriates and international workers has resulted in higher remittance volumes. Furthermore, technological advancements, such as mobile payment apps and blockchain-based platforms, have made digital remittance more secure and accessible. Government initiatives promoting financial inclusion and reducing remittance costs have also played a crucial role. Additionally, the COVID-19 pandemic has accelerated the adoption of digital remittance services as consumers increasingly prefer contactless and online transactions.

𝗕𝘂𝘆 𝗟𝗮𝘁𝗲𝘀𝘁 𝗘𝗱𝗶𝘁𝗶𝗼𝗻 𝗼𝗳 𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝘁𝘂𝗱𝘆 𝗡𝗼𝘄:

https://www.wiseguyreports.com/checkout?currency=one_user-USD&report_id=579597

𝗠𝗮𝗿𝗸𝗲𝘁 𝗢𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝗶𝗲𝘀

The digital remittance service market offers vast opportunities for innovation and expansion. Emerging economies in regions such as Asia-Pacific and Africa present significant growth potential due to the high demand for remittance services and limited access to traditional banking infrastructure. The integration of advanced technologies like blockchain and artificial intelligence is revolutionizing the industry by enhancing security, transparency, and operational efficiency. Additionally, partnerships between digital remittance providers and local financial institutions can help expand their reach and customer base. Customizing services for underserved segments, such as migrant workers, also represents a lucrative opportunity.

𝗥𝗲𝘀𝘁𝗿𝗮𝗶𝗻𝘁𝘀 𝗮𝗻𝗱 𝗖𝗵𝗮𝗹𝗹𝗲𝗻𝗴𝗲𝘀

Despite its growth prospects, the digital remittance service market faces several challenges. Regulatory complexities and varying compliance requirements across different countries can hinder market expansion. High transaction fees in some regions remain a significant barrier, deterring customers from fully transitioning to digital platforms. Additionally, concerns regarding data security and fraud pose risks to both providers and users. Limited digital literacy and access to the internet in remote areas further restrict market penetration. Overcoming these challenges requires robust regulatory frameworks, innovative cost-reduction strategies, and efforts to improve digital literacy and infrastructure.

𝗥𝗲𝗴𝗶𝗼𝗻𝗮𝗹 𝗔𝗻𝗮𝗹𝘆𝘀𝗶𝘀

The digital remittance service market exhibits regional variations in growth and adoption. Asia-Pacific leads the market, driven by high remittance inflows from countries like India, China, and the Philippines. The region’s large expatriate population and rising smartphone penetration fuel market demand. North America and Europe are significant contributors, with well-established digital infrastructure and a tech-savvy population. In contrast, the Middle East and Africa hold immense growth potential, as digital remittance adoption is increasing due to financial inclusion initiatives. Latin America is also witnessing steady growth, supported by diaspora populations and improved access to digital payment solutions.

𝗩𝗶𝗲𝘄 𝗗𝗲𝘁𝗮𝗶𝗹𝗲𝗱 𝗠𝗮𝗿𝗸𝗲𝘁 𝗥𝗲𝘀𝗲𝗮𝗿𝗰𝗵 𝗙𝗶𝗻𝗱𝗶𝗻𝗴𝘀:

https://www.wiseguyreports.com/reports/digital-remittance-service-market

𝗥𝗲𝗰𝗲𝗻𝘁 𝗗𝗲𝘃𝗲𝗹𝗼𝗽𝗺𝗲𝗻𝘁𝘀

Recent developments in the digital remittance service market reflect a focus on innovation and customer-centric strategies. Companies are increasingly adopting blockchain technology to improve transaction security and reduce costs. For example, Ripple has partnered with banks to facilitate blockchain-based cross-border payments. Mobile apps offering multi-currency wallets and real-time exchange rate updates are gaining popularity. Additionally, several providers are expanding their services to underserved regions through strategic partnerships with local financial institutions. The entry of fintech startups and the adoption of AI-powered fraud detection systems further highlight the market's dynamic nature, signaling continued growth and transformation.

𝗧𝗼𝗽 𝗧𝗿𝗲𝗻𝗱𝗶𝗻𝗴 𝗥𝗲𝗽𝗼𝗿𝘁𝘀:

𝗜𝗻𝘁𝗲𝗴𝗿𝗮𝘁𝗲𝗱 𝟯𝗗 𝗥𝗮𝗱𝗮𝗿 𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗶𝘇𝗲 -

https://www.wiseguyreports.com/reports/integrated-3d-radar-market

𝗩𝗶𝗿𝘁𝘂𝗮𝗹 𝗕𝗿𝗼𝗮𝗱𝗯𝗮𝗻𝗱 𝗡𝗲𝘁𝘄𝗼𝗿𝗸 𝗚𝗮𝘁𝗲𝘄𝗮𝘆 𝗠𝗮𝗿𝗸𝗲𝘁 -

https://www.wiseguyreports.com/reports/virtual-broadband-network-gateway-vbng-market

𝗦𝘁𝗼𝗿𝗮𝗴𝗲 𝗔𝗿𝗲𝗮 𝗡𝗲𝘁𝘄𝗼𝗿𝗸 𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗵𝗮𝗿𝗲 -

https://www.wiseguyreports.com/reports/storage-area-network-san-market

𝗞𝗮 𝗕𝗮𝗻𝗱 𝗦𝗮𝘁𝗰𝗼𝗺 𝗢𝗻 𝗧𝗵𝗲 𝗠𝗼𝘃𝗲 𝗠𝗮𝗿𝗸𝗲𝘁 -

https://www.wiseguyreports.com/reports/ka-band-satcom-on-the-move-market

𝗘𝗻𝘁𝗲𝗿𝗽𝗿𝗶𝘀𝗲 𝗪𝗶𝗿𝗲𝗹𝗲𝘀𝘀 𝗟𝗼𝗰𝗮𝗹 𝗔𝗿𝗲𝗮 𝗡𝗲𝘁𝘄𝗼𝗿𝗸 𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗶𝘇𝗲 -

https://www.wiseguyreports.com/reports/enterprise-wireless-local-area-network-wlan-market

𝗦𝗮𝘁𝗲𝗹𝗹𝗶𝘁𝗲 𝗠𝗮𝗰𝗵𝗶𝗻𝗲 𝗧𝗼 𝗠𝗮𝗰𝗵𝗶𝗻𝗲 𝗠𝟮𝗠 𝗖𝗼𝗺𝗺𝘂𝗻𝗶𝗰𝗮𝘁𝗶𝗼𝗻𝘀 𝗠𝗮𝗿𝗸𝗲𝘁 -

https://www.wiseguyreports.com/reports/satellite-machine-to-machine-m2m-communications-market

𝗩𝗲𝗰𝘁𝗼𝗿 𝗡𝗲𝘁𝘄𝗼𝗿𝗸 𝗔𝗻𝗮𝗹𝘆𝘇𝗲𝗿 𝗩𝗻𝗮 𝗖𝗮𝗹𝗶𝗯𝗿𝗮𝘁𝗶𝗼𝗻 𝗞𝗶𝘁 𝗠𝗮𝗿𝗸𝗲𝘁 -

https://www.wiseguyreports.com/reports/vector-network-analyzer-vna-calibration-kit-market

𝗔𝗯𝗼𝘂𝘁 𝗨𝗦:

Wise Guy Reports is pleased to introduce itself as a leading provider of insightful market research solutions that adapt to the ever-changing demands of businesses around the globe. By offering comprehensive market intelligence, our company enables corporate organizations to make informed choices, drive growth, and stay ahead in competitive markets.

We have a team of experts who blend industry knowledge and cutting-edge research methodologies to provide excellent insights across various sectors. Whether exploring new market opportunities, appraising consumer behavior, or evaluating competitive landscapes, we offer bespoke research solutions for your specific objectives.

At Wise Guy Reports, accuracy, reliability, and timeliness are our main priorities when preparing our deliverables. We want our clients to have information that can be used to act upon their strategic initiatives. We, therefore, aim to be your trustworthy partner within dynamic business settings through excellence and innovation.

𝗖𝗼𝗻𝘁𝗮𝗰𝘁 𝗨𝗦:

WISEGUY RESEARCH CONSULTANTS PVT LTD

Office No. 528, Amanora Chambers Pune - 411028

Maharashtra, India 411028

Sales +91 20 6912 2998

WiseGuyReports (WGR)

WISEGUY RESEARCH CONSULTANTS PVT LTD

+1 628-258-0070

email us here

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release