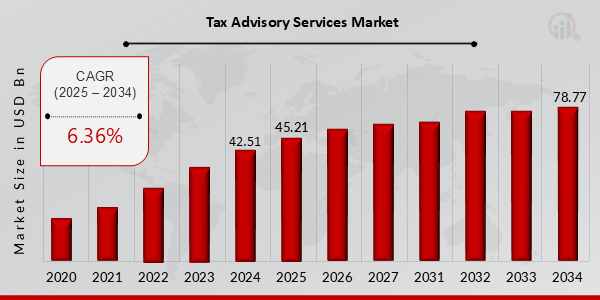

Tax Advisory Services Market is likely to Grow at a CAGR of 6.36% Through 2034, Reaching US$ 78.77 Billion

Tax Advisory Services Market Growth

Tax Advisory Services Market Research Report By, Service Type, End User Industry, Organization Size, Deployment Model, Regional

NH, UNITED STATES, March 20, 2025 /EINPresswire.com/ -- The global Tax Advisory Services market has experienced steady growth in recent years and is expected to expand further in the coming decade. The market size was estimated at USD 42.51 billion in 2024 and is projected to grow from USD 45.21 billion in 2025 to an impressive USD 78.77 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 6.36% during the forecast period (2025–2034). The increasing complexity of tax regulations, globalization of businesses, and rising demand for tax compliance and strategic planning services are the key drivers propelling market growth.

Key Drivers Of Market Growth

Increasing Complexity of Tax Regulations With governments continuously updating tax policies and introducing new compliance requirements, businesses and individuals seek professional tax advisory services to ensure compliance and optimize tax liabilities.

Globalization of Businesses The expansion of multinational corporations and cross-border trade has led to increased demand for tax advisory services to navigate international tax laws and treaties effectively.

Rising Demand for Tax Compliance and Strategic Planning Businesses are focusing on long-term tax strategies to enhance financial efficiency, minimize risks, and take advantage of available tax benefits, thereby driving the growth of tax advisory services.

Adoption of Technology in Tax Advisory Services The integration of artificial intelligence (AI), big data analytics, and automation in tax advisory services is streamlining tax planning, risk assessment, and compliance management, further fueling market expansion.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/24697

Key Companies in the Tax Advisory Services Market Include

• Crowe

• RSM International

• BDO

• HLB Global

• Mazars

• KPMG

• Moore Global

• Grant Thornton

• Baker Tilly

• WTS Global

• EY

• Nexia International

• RSM

• Deloitte

• PwC

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/tax-advisory-services-market-24697

Market Segmentation To provide a comprehensive analysis, the Tax Advisory Services market is segmented based on service type, enterprise size, industry vertical, and region.

1. By Service Type

• Tax Compliance Services: Assistance with filing tax returns and ensuring adherence to regulatory requirements.

• Tax Planning & Consulting: Strategic advisory services to optimize tax savings and reduce liabilities.

• International Tax Advisory: Specialized services for multinational corporations navigating global tax regulations.

• Transactional Tax Services: Advisory on tax implications related to mergers, acquisitions, and business restructuring.

2. By Enterprise Size

• Small and Medium Enterprises (SMEs): Growing adoption of outsourced tax advisory services to manage compliance efficiently.

• Large Enterprises: Increased demand for sophisticated tax planning and international tax structuring.

3. By Industry Vertical

• Financial Services: High regulatory scrutiny driving demand for expert tax advisory services.

• Healthcare: Compliance with evolving tax regulations in the healthcare sector.

• IT & Telecom: Tax optimization strategies for technology-driven companies.

• Manufacturing: Focus on cost-saving tax strategies and incentives.

• Retail & E-commerce: Demand for indirect tax management, including VAT and GST.

4. By Region

• North America: Leading market driven by stringent tax regulations and corporate tax planning needs.

• Europe: Growth fueled by evolving tax policies and compliance requirements.

• Asia-Pacific: Fastest-growing region due to increasing globalization and economic expansion.

• Rest of the World (RoW): Emerging markets in Latin America, the Middle East, and Africa showing steady demand for tax advisory services.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24697

The global Tax Advisory Services market is set to grow steadily, driven by the increasing complexity of tax regulations, rising globalization, and the adoption of technology in tax compliance and planning. As businesses and individuals seek expert guidance to navigate ever-evolving tax landscapes, the demand for tax advisory services is expected to surge across various industries and regions.

Related Report:

Community Banking Market

Balanced Funds Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release